Copperas Cove city council: Go forward with plans for transportation utility fee

By LYNETTE SOWELL

Cove Leader-Press

At last Friday’s Copperas Cove city council retreat, one of the items on the agenda was discussing a possible transportation utility fee – a new monthly fee that would be charged to residential and commercial utility accounts.

This fee would be used for the maintenance and repair of the city’s streets and be added to the fund of money that already comes in through ½-cent of the city’s sales tax dollars.

Public Works Director Scott Osborn explained that although ½-cent of the city’s sales tax revenue is used for the city’s Streets Department funds, there is still a lot to accomplish in terms of catching up on approximately $52 million in needed repairs, as per a 2021 street condition assessment.

NewGen Strategies and Solutions, LLC conducted a transportation utility fee analysis to be used as a potential solution to this problem. This is a fee that would be assessed to all residents and businesses with utility accounts, instead of raising additional property taxes to fund the repairs and maintenance.

Matthew Garrett with NewGen explained the potential figures as well as the revenue impact that could be generated by this fee.

“This is not finished and ready to plug into a system and start tomorrow, but rather as a number to review, to give thought to as a potential strategy for street maintenance needs,” he told the council.

Garrett explained how NewGen arrived at the possible fee amounts and calculations, depending on the business or resident property.

“The cost would be allocated to residents and businesses based on their use of roads,” he said.

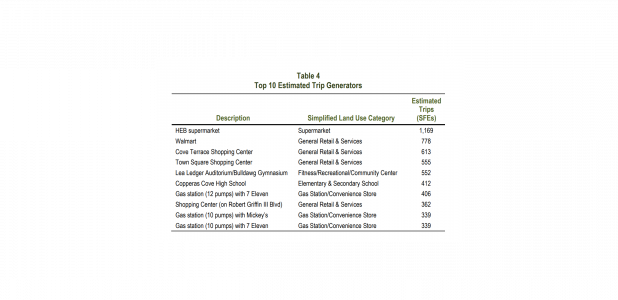

NewGen used a method to identify and estimate the number of “trips” taken per day by those who occupy different types of residential property, as well as the estimated number of “trips” different local businesses generate based on their property size and function.

Altogether, NewGen’s study estimates that a total of 33,940 trips take place in the evening time period each day, with residential properties making up about 12,986 of those trips (38%), and nonresidential making up 20,954 of those trips (62%).

H-E-B, Walmart, and Cove Terrace Shopping Center accounted for the most number of trips generated each day.

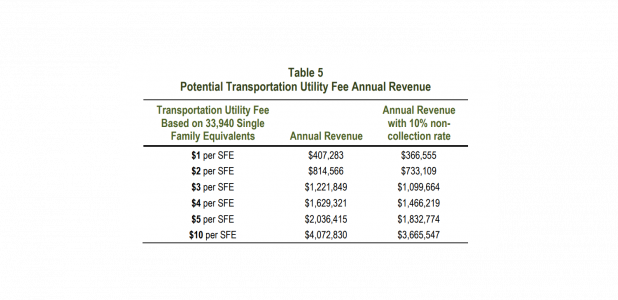

The trips are then converted to Single Family Equivalents (SFEs) which would be used to base the fee structure. There is no one flat amount for this fee but could potentially range from $1 per month for each Single Family Equivalent (SFE), to as much as a possible $10 per SFE.

With those types of rates, additional revenue could start as low as $407, 283 annually, or at the maximum, $4,072,830 annually, which would all go to street repair and maintenance.

NewGen’s study revealed that this doesn’t assume any particular entity, such as schools or churches, would get any type of a discount or exemption, but pay the full fee.

Councilmember Smith mentioned looking at exemptions for the fee.

“I know that we could make exemptions and things like that, but it has to be fair across the board. But is there any way to dis-exempt grocery stores? I wouldn’t be for it. I’m just asking that.”

Scott Osborn said that this was brought up in other contexts like under impact fees.

“The goal of this is to be proportional, to accurately reflect across the community, where is that demand? You know, while I recommend we stay away from absolute exemptions to the extent that the council believes it’s prudent. For example, I see a lot of communities exempt city property, which means, you don’t pay yourself, right? Additionally, county and federal activities. I’ve seen other cities excempt the ISDs. However, there’s a lot of pressure put on the street network by the traffic associated with school districts. With that being said, City Council does have the discretion.”

Councilmember Fred Chavez said the time to move forward on this plan is now.

“I think it’s contingent upon us to look at every tool we have, as I’ve said before, take a look at it running through our committees, see what’s presented, and see where we go from there. We have a plan. I think it’s a good plan, but we need to look through it. We need to move forward with this. I think if we kick the can down the road, which we’ve sometimes done, it never ends up well.”

Councilmember Vonya Hart said that she is always up for exploring options.

Councilmember Jack Smith voiced his support for the fee.

“Surprisingly, I am for a transportation fee. I think we need to do a little bit more study on it. I think that it needs to be billed through the water department. I’m ready to move forward with it.”

Mayor Dan Yancey said we need to look at every potential new revenue to offset expenses coming in, one way or the other. “So planning and attacking it is always much better than reacting.”

“No one wants to pay it, but everybody wants good roads,” Smith added.

The council will hear more from the city in the months ahead about what the recommendations are and any type of fee cap, if any, in addition to any proposed exemptions.

“City council does have that discretion in terms of creating exemptions,” Haverlah said.

There is no estimated date as to when the city would bring this back to the council, nor when this new fee structure would go into effect.

Before this proposed fee would be brought back to the city council, the city administration has several things to do, according to the study results, prior to actually drafting the ordinance and the council voting to add this to the city’s fee list.

Those steps are linking utility bills to land parcels, categorizing residential dwellings, reviewing land use allocations, deciding on a proposed fee structure as well as proposing any exemptions, and also being proactive on educating the public on the future fees, with “special care” being taken with those nonresidential customers that will see the largest fee amounts.

This type of fee isn’t anything new in the state of Texas. Among the cities that use this type of fee are large cities to small, such as Austin, Bryan, and Waco.

So far with the use of the sales tax funds, the Streets Department has had funds for four full-time employees and also enough revenue to buy equipment. The department was able to start performing crack seal on roadways and also removing vegetation that can contribute to deteriorating roadways. In 2019, the first substantial roadway maintenance projects included mill and overlay on Robertson and North Main Street, some slurry seal on Colorado and various other roadways throughout the city.

“Then in 2021, winter storm Uri hit us which resulted in over 300 discrete locations of street damage. So while that fund had built up a decent sized reserve, those damages basically ate up those funds. As we had to get out and repair Big Divide again, we had to do Freedom Lane, and a portion of Ogletree (Pass), and city crews actually took care about 80 percent of those repairs in-house. But ultimately, Mr. Haverlah mentioned Lutheran Church Road that was one of the remaining ones most recently, this year, so we’re moving on right around 2021 2022.”

With the 2023-2024 fiscal year budget, street maintenance is funded through those sales tax allocations at approximately $1.2 million total, with projected expenses of about $1.18 million, with $400,000 earmarked for maintenance projects, Osborn said.

The pavement condition study included 2021 figures, Osborn said.

“Those were the unit costs then, but these are not the unit costs now. For example, the cost of asphalt has risen since that time. At this point, we’ve had inflation, we’ve had minimal maintenance budgets, but we’ve done what we can, that was the number back then and it would be hard today.”